There is a substantial need for housing resources across our nation’s small town and farming communities. Although homeownership is the predominate type of housing available in rural America, rural housing is much more likely to be substandard than in urban areas. In fact, six percent of rural homes are either moderately or severely substandard, often with leaking roofs, or inadequate plumbing or heating systems. Affordability issues also plague rural communities, with some eight million rural families paying more than 30% of income for housing, and 23% of all rural families paying more than 35% of income for shelter. To improve the quality and affordability of housing in their communities, local governments and nonprofit groups rely, in part, on HOME Investment Partnership Program (HOME program) funding.

Authorized by the Cranston-Gonzalez National Affordable Housing Act of 1990 (PL 101-625), the HOME program was designed to benefit low and very-low income Americans by increasing federal support for affordable housing. Since its creation in 1990, the HOME program has financed more than 1.1 million affordable homes for low and very-low income households.

The HOME program, administered by the United States Department of Housing and Urban Development, provides federal block grants to states, local governments, and consortia, called Participating Jurisdictions or PJs, which use the funding to develop and support affordable housing in their communities. All PJs are required to provide matching contributions of at least 25% of the HOME funds spent for tenant-based rental assistance, rehabilitation, acquisition, and new construction, although the matching requirement can be reduced for PJs experiencing financial distress or severe financial distress.

PJs use HOME grants to support a variety of activities to meet the specific housing needs of their communities. Some activities include site acquisition, site improvements, demolition, and relocation. PJs also use HOME funding as a source of critical gap financing to ensure the success so rental housing funded with the Low-Income Housing Tax Credit or other federal, state, or local housing projects. HOME funds can be used for both permanent and rental housing. All PJs must commit HOME funds within 24 months of receipt, and they must be expended within five years. Although there is no set-aside for rural areas under the HOME program, states receive 40 percent of HOME funds each year, which may in turn be used by smaller and rural communities.

While most HUD programs have limited utility for rural communities, the structure of the HOME program allows it to serve as a central tool to improve the quality of housing for rural residents. Because HOME funds can be utilized in many different ways to support a communities’ affordable housing needs, localities and non-profits are able to use HOME programs allocations in conjunction with funding from other sources, such as Section 502 loans from the United States Department of Agriculture (USDA) to adequately fund their projects. Rural Housing programs administered by the USDA has been repeatedly reduced in recent years – between 2010 and 2015, USDA rural housing budget authority was reduced by 54%. Thus, HOME is particularly important for rural areas.

HOME program funding has been used to assist rural communities all around the country. Specific HOME program funded projects include:

- In Morehead, Kentucky, single mother Kayla Brooks, with help from Frontier Housing and the HOME program was able to purchase a home for her and her then five-year-old daughter Alanah. Because of the financing package, Ms. Brooks now spends just $140 more on her monthly mortgage than what she paid in rent and utilities.

- NCALL Research and the Milford Housing Development Corporation worked together in Middletown, Delaware to help ensure that North Lake Village, a 52-unit rental community that was one of the only sources of affordable housing in town, received the substantial upgrades it desperately needed. Thanks to $1.82 million in HUD HOME funding in conjunction with other sources of funding, North Lake Village’s renovations were completed in 2013. Today residents enjoy improvements including a new exterior, plumbing, electrical, HVAC, and appliances, as well as a new playground, larger laundry facilities, and a computer station.

- Up until 2011, Wright, Wyoming, which is the nearest town to many of Wyoming’s coal mines, had no affordable housing whatsoever. Wyoming Community Development Authority (WCDA) utilized HOME funds and the Low Income Housing Tax Credit to develop Wrightland Apartments, which includes 11 two-bedroom units, each with their own garage for the fierce Wyoming winters, exclusively targeted to families who earn less than 50 percent of the Area Median Income.

Unfortunately, the development and continuation of projects like these are currently being threatened by severe cuts to HOME program funding levels.

The past several years have shown a steady decline in HOME program funding. From FY 2009 to FY 2011, funding for the program dropped about 9.5%, from $1,825,000,000 to $1,650,000,000. Since FY 2011, the funding for the HOME program has been further cut – decreasing $650,000,000 from FY 2011 to FY 2012. Although the funding for the HOME program was increased in FY 2013, from $1,000,000,000 to $1,006,120,000, it was reduced to an all-time low for FY 2015, when it was funded at only $900,000,000.

According to a Rural Work Group report, the HOME program in the past provided over $500 million annually in affordable housing and homeownership programs for rural areas.[1] While this amount has decreased in recent years as overall funding to the HOME program has been reduced, this program still provides crucial assistance to some of the country’s communities most in need.

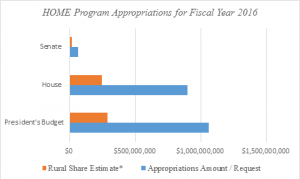

*Estimation is 68% of 40% of the Appropriations Amount (the state allocations), based on the Rural Work Group Report finding that up to 2012 about $500 million of HOME funds annually went to support rural areas.[2]

For FY 2016, the President’s budget request would fund home at $1.06 billion, while the House appropriations would fund the HOME program at $900 million, the FY 2015 rate. The most drastic cut is from the Senate appropriations bill, which would fund the HOME program at only $66 million, which is $834,000,000 less than the FY 2015 amount.

*Estimation is 68% of 40% of the Appropriations Amount (the state allocations), based on the Rural Work Group Report finding that up to 2012 about $500 million of HOME funds annually went to support rural areas. [3]

As the chart above illustrates, if the HOME program is funded at the Senate appropriations level, rural communities will be able to access less than $18,000,000 to meet their affordable housing needs with the HOME program.

Of HUD’s total budget of approximately $45 billion, less than 15 percent goes to rural areas. The HOME program, funded at the requested level of $1,060,000,000 for FY16 is only a small fraction of HUD’s total budget, but goes a long way to improving the state of housing for rural America. If funding for HOME is not increased, projects such as the ones in Wyoming, Kentucky, and Delaware highlighted above will not be possible, and the residents of rural America will be left without safe and decent affordable housing options.

In light of the fact that a total of 19.3 percent of the population of the United States lives in rural area, fully funding the HOME Program for Fiscal Year 2016 will go a long way to providing crucial resource for America’s rural residents.

[1] https://www.fhwa.dot.gov/planning/publications/sustainable_rural_communities/page05.cfm (2012). The Rural Work Group was established by the Partnership for Sustainable Communities in collaboration with USDA.

[2] https://www.fhwa.dot.gov/planning/publications/sustainable_rural_communities/page05.cfm (2012).

[3] https://www.fhwa.dot.gov/planning/publications/sustainable_rural_communities/page05.cfm (2012).